LUXE INVESTMENTS

Floor 6

International House

4 Maddox Street

Mayfair

London W1S 1QP

UK

+44 (0)207 856 0159

Follow us on Instagram

|

LUXE WATCH INVESTMENTS

Time is Money

‘Many Patek Philippe watches acquired during the past century are being worn today by the fourth generation of the same family. What could be a finer investment?’

Patek Philippe

New Paragraph

Why invest in luxury watches?

LUXE INVESTMENTS

With the demand for high-end watches from the most recognised and established brands simply exceeding market supply, long waiting lists have pushed customers to the secondary market, which has seen its own growth – in both prices and trading activity – as a result. A 2021 report by McKinsey and The Business of Fashion put annual growth in the pre-owned watch market at 8 to 10 per cent from 2019 to 2025, with sales forecast to reach between $29bn and $32bn. The pre-owned market has managed to attract a slew of enthusiasts who are shifting the market with differing buying habits. Over the past two years, women have become a rising consumer segment within a normally male dominated arena. The market is also particularly strong among young consumers, with 42 per cent of millennials and 34 per cent of Gen-Zs saying that they would buy a pre-owned luxury watch.

Source: FT, 7 October 2022

‘Watches top Knight Frank Luxury Investment Index, with 10 year growth performance of 108%.’

Source: Knight Frank Luxury Investment Index results, Q4 2021

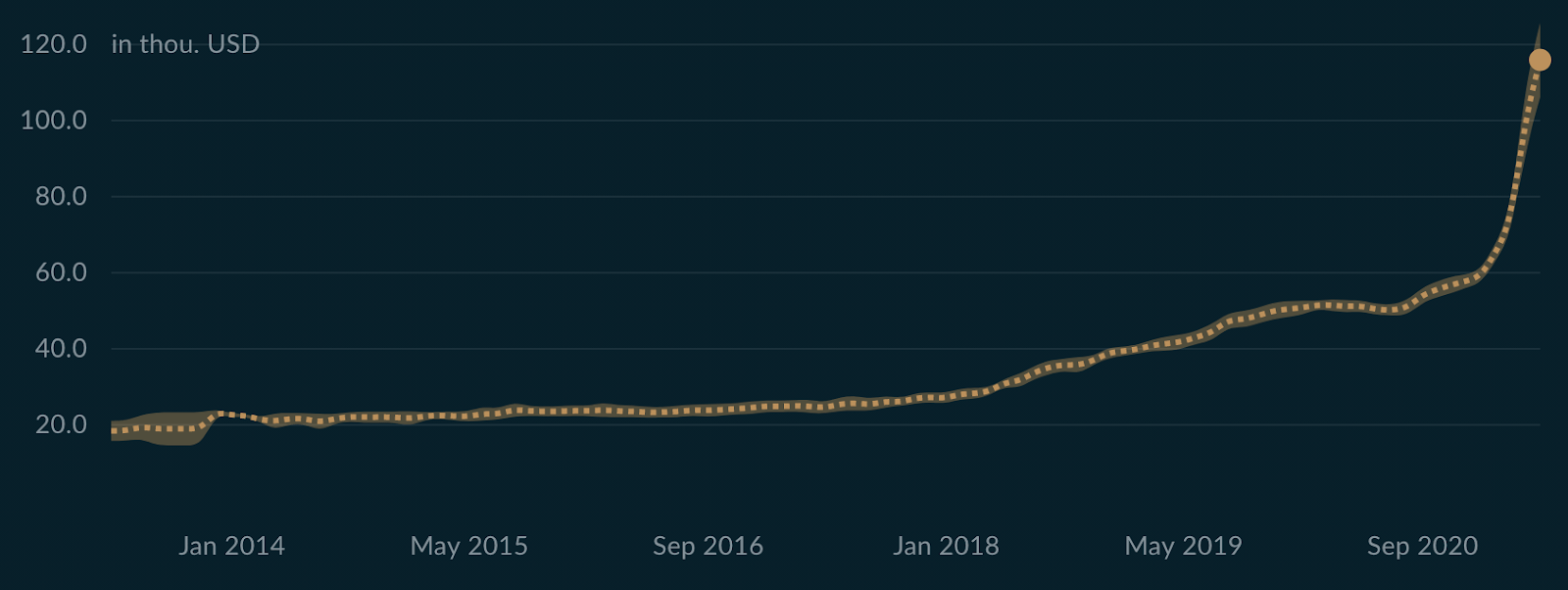

Audemars Piguet Royal Oak value growth. Source: Chrono24

See our current collection

LUXE Watch INVESTMENTS

5 ATTRIBUTES THAT DEFINE THE VALUE OF A LUXURY TIMEPIECE

LUXE Watch INVESTMENTS

step

01

online application

1

Brand Equity

2

Quality of MaterialS

3

Crafts-manship

Craftsmanship

4

Provenance

5

Scarcity

/Limited editions

LUXE INVESTMENTS

Floor 6

International House

4 Maddox Street

Mayfair

London W1S 1QP

UK

+44 (0)207 856 0159

Follow us on Instagram